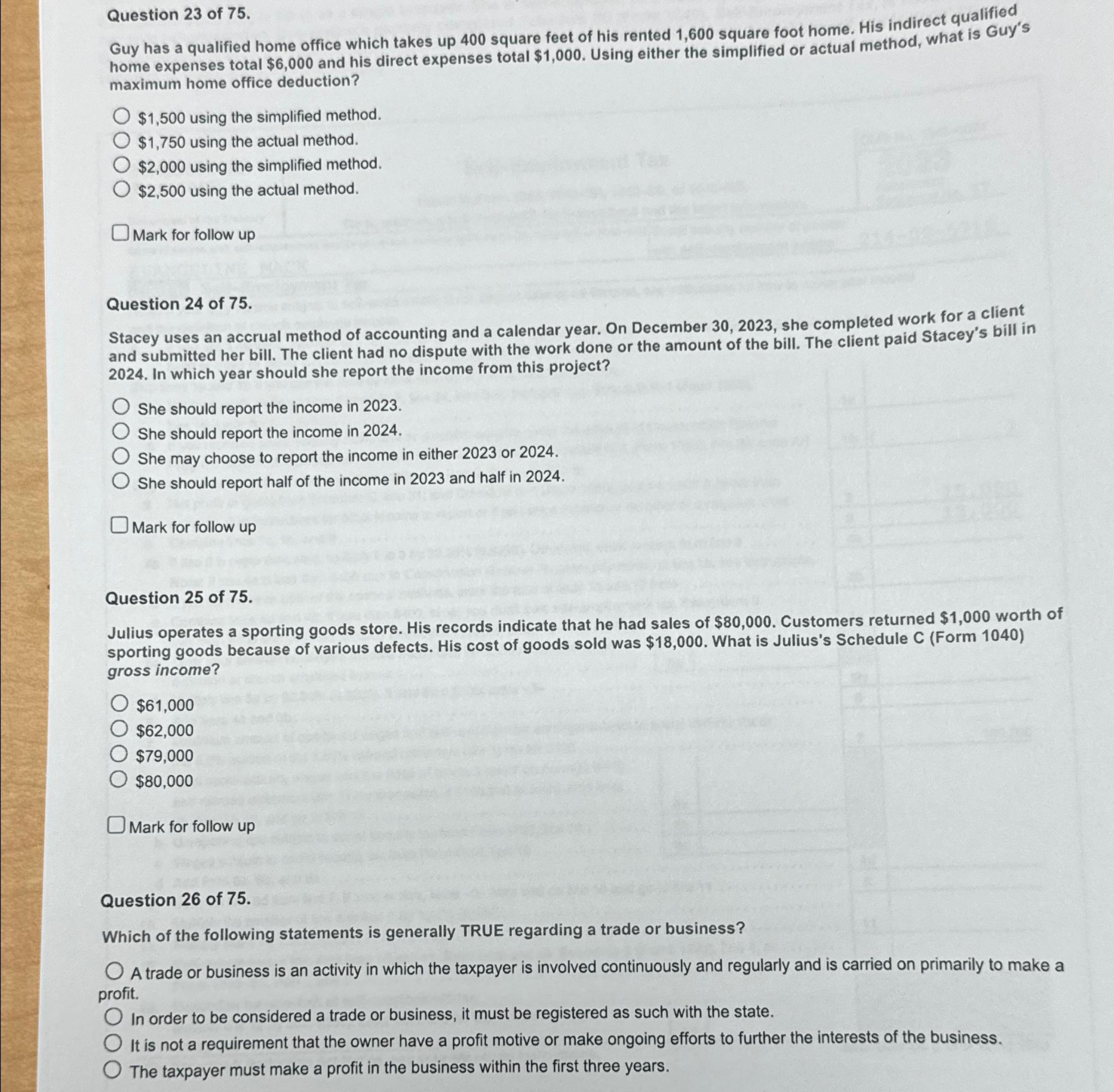

Home Office Simplified Method 2024 Form – Employees who worked from home by choice last year under an agreement with their employer will be able to claim employment expenses on their tax return, the CRA says. Typically, an employee must be . If you worked remotely in 2023, you may be curious about the home office deduction. Here’s who qualifies for the tax break this season, according to experts. .

Home Office Simplified Method 2024 Form

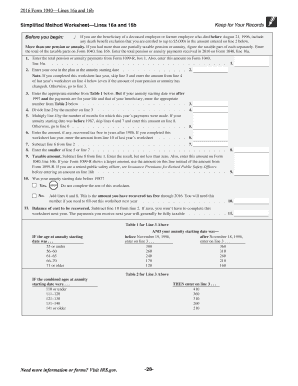

Source : www.chegg.comSimplified Method Worksheet Home Office Deduction 2015 2024 Form

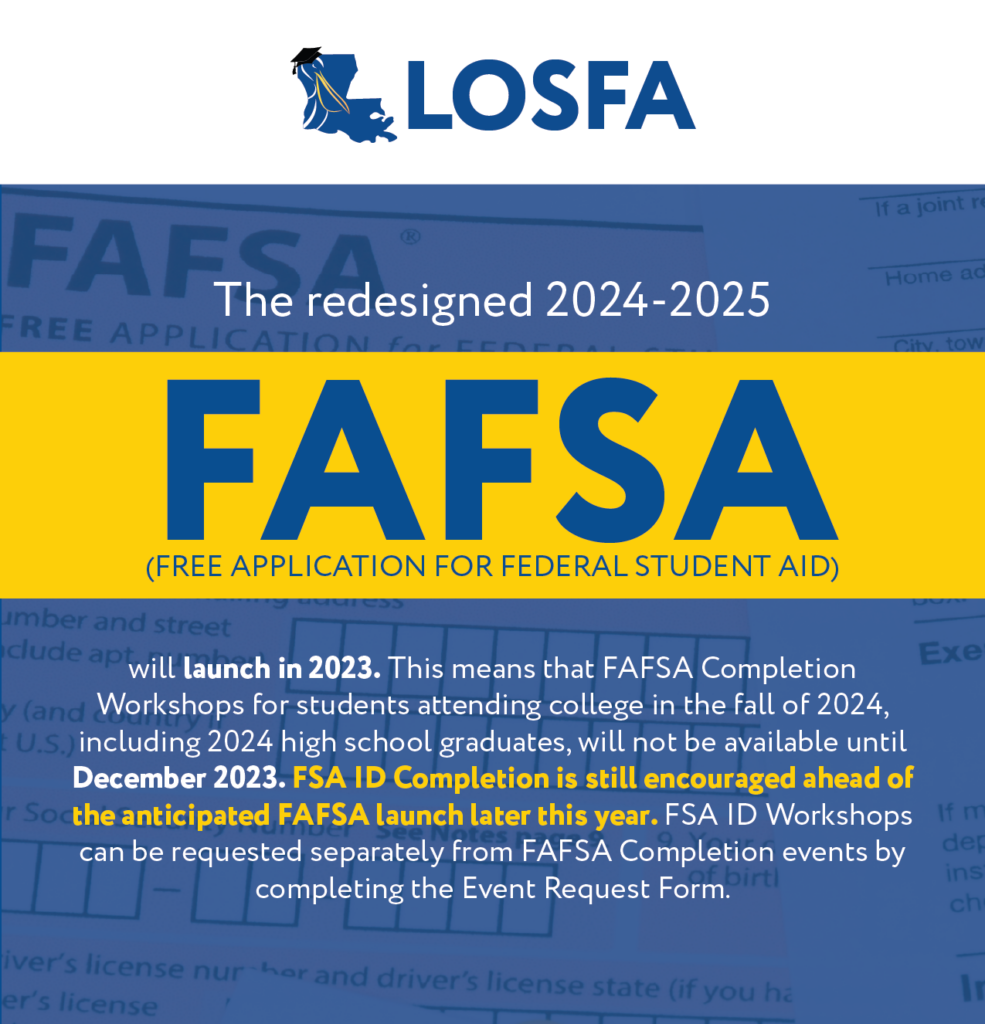

Source : www.signnow.comFAFSA Application Process | Student Affairs and Campus Diversity

Source : sacd.sdsu.eduSimplified Home Office Deduction Explained: Should I Use It?

Source : www.keepertax.comSilver Cross Hospital on X: “By incorporating philanthropy into

Source : twitter.comBest office chairs in 2024, tried and tested | CNN Underscored

Source : www.cnn.comRequest a LOSFA Event | Louisiana Office of Student Financial

Source : mylosfa.la.govBest office chairs in 2024, tried and tested | CNN Underscored

Source : www.cnn.comInterior Design Trends 2024: Fresh Ways to Reinvent Your Home

Source : www.decorilla.comI Spent New Year’s Eve Trying to Do the FAFSA. It Didn’t Go Well

Source : www.nytimes.comHome Office Simplified Method 2024 Form Solved Question 23 of 75.Guy has a qualified home office | Chegg.com: To deduct your mortgage interest, you’ll need to fill out IRS Form 1098, which you should receive from your lender in early 2024 The “regular method” for deducting a home office involves . If you’re one of the millions of Canadians who worked from home during 2023, either full time or on a hybrid-work arrangement, you’ll need to take some extra time this tax filing season if you want to .

]]>